Data from short-term rental platform Chalet shows Florida, California, and Texas comprised 32.5% of all Airbnb market searches conducted through its tools in 2025, demonstrating the Sun Belt's continued dominance in investor attention. This search activity translated directly into purchases, with these three states accounting for 69% of the platform's closed deals last year. Regional vacation markets significantly outperformed major urban centers in search engagement, with secondary "drive-to" destinations seeing higher engagement rates per listing than traditional big-city hotspots.

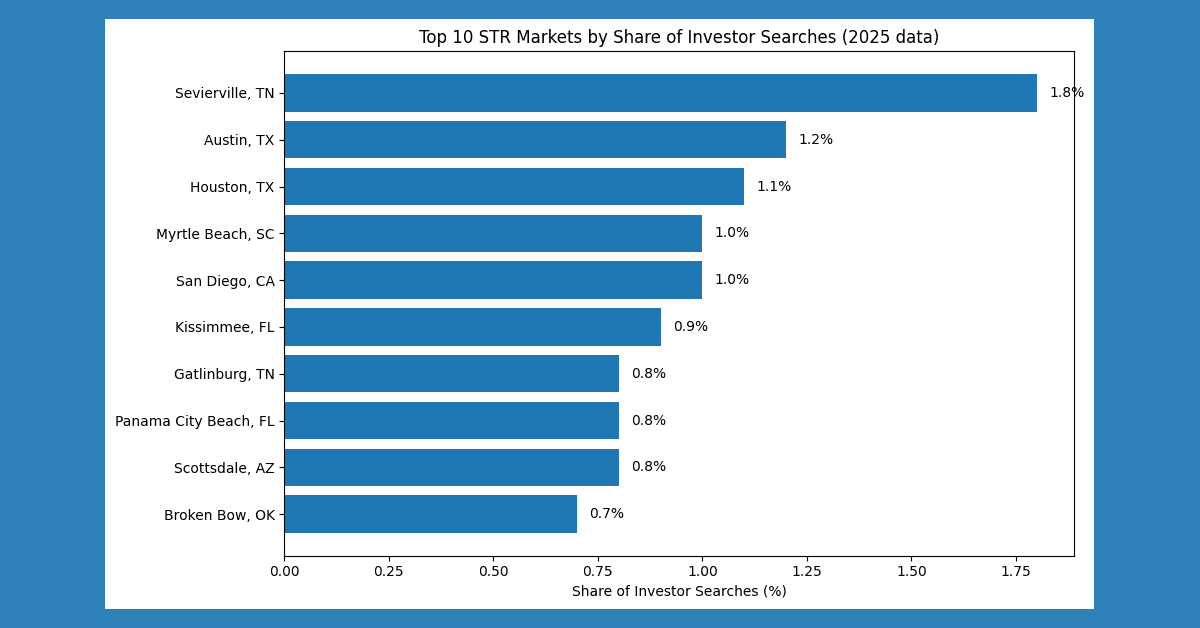

Nearly 70% of the 30 most-searched markets were regional or destination-driven rather than large metros, with Sevierville, Tennessee, a gateway to the Smoky Mountains, ranking as the most-searched individual city with 1.8% of total searches. This outpaced Austin, Texas (1.2%), Houston, Texas (1.1%), and San Diego, California (1.0%). This search behavior closely mirrored actual investment activity, with nearly 73% of Chalet-assisted deals closing in regional markets. The platform reported closing 205% more short-term rental property deals in 2025 compared to the previous year, indicating users are converting analysis into executed transactions at an accelerated pace.

While searches were widely distributed across many markets, execution remained more concentrated, with Austin emerging as the most active market for closed deals at just over 9% of all transactions. Strict regulatory environments significantly suppressed market interest, with cities like New York City and Los Angeles attracting under 0.2% of all searches despite their tourism prominence. This pattern highlights how restrictive short-term rental frameworks limit investment viability, pushing activity toward markets with more host-friendly policies. The company's free interactive market dashboard provides ongoing access to these search trends and market analytics.

"The overwhelming focus on Sun Belt states is both a warning and an opportunity," said Ashley Durmo, CEO of Chalet. "It shows where momentum is strongest, but also where markets may be overheating. Our goal is to arm users with unbiased data so they can spot the next big market or avoid the next saturated hotspot." The data reveals that while capital deployment remains selective, search behavior is broadly distributed, with the most-searched individual market accounting for only about 1.8% of total searches, indicating fragmented market interest across dozens of locations. This fragmentation suggests investors are actively exploring diverse opportunities beyond traditional hotspots, potentially signaling a maturing market where data-driven decisions are becoming increasingly crucial for identifying viable investment opportunities in an evolving regulatory landscape.