Locksley Resources Limited announced the successful completion of a heavily oversubscribed capital raising, securing firm commitments of approximately A$17 million through a placement of new shares. The placement, managed by Alpine Capital Pty Ltd. and Titan Partners Group, a division of American Capital Partners, attracted cornerstone participation from established U.S. institutional investors at A$0.24 per share. This capital raising underscores significant investor support for the company's strategy to develop a fully integrated U.S.-based mine-to-market critical minerals supply chain.

Proceeds from the placement will support downstream development objectives as part of Locksley's broader U.S. Critical Minerals and Energy Resilience Strategy. The company is advancing its U.S. asset, the Mojave Project in California, which targets rare earth elements and antimony through the Desert Antimony Mine. Locksley's strategic collaboration with Rice University to develop DeepSolv technology represents a cornerstone of its approach to domestic processing of North American antimony. This agreement aims to accelerate mine-to-market deployment of antimony in the United States.

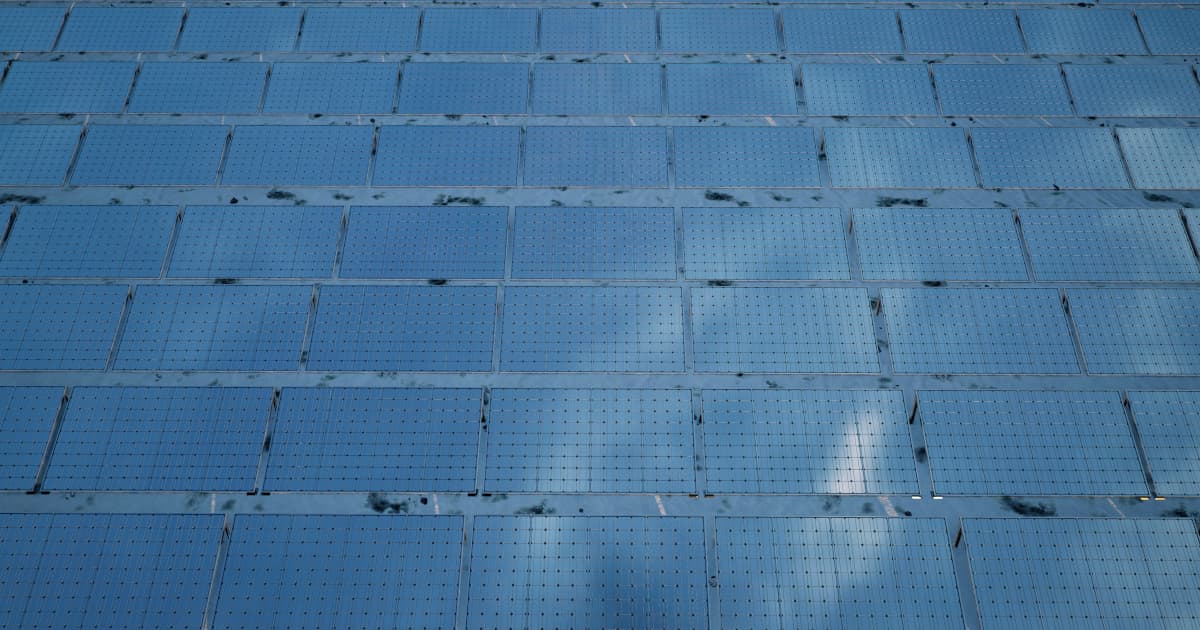

The successful capital raising comes at a time when Western nations are seeking to reduce dependence on foreign sources of critical minerals essential for defense, technology, and renewable energy applications. Locksley's focus on establishing domestic supply chains for rare earth elements and antimony addresses strategic vulnerabilities in materials crucial for everything from electric vehicles to military equipment. The placement announcement was distributed through specialized communications platforms including MiningNewsWire, which provides distribution services to the mining and resources sectors through its network of financial news brands. For more information about the company's projects and strategy, visit https://locksleyresources.com.au/.